最新更新 // 發布了新的更新版本

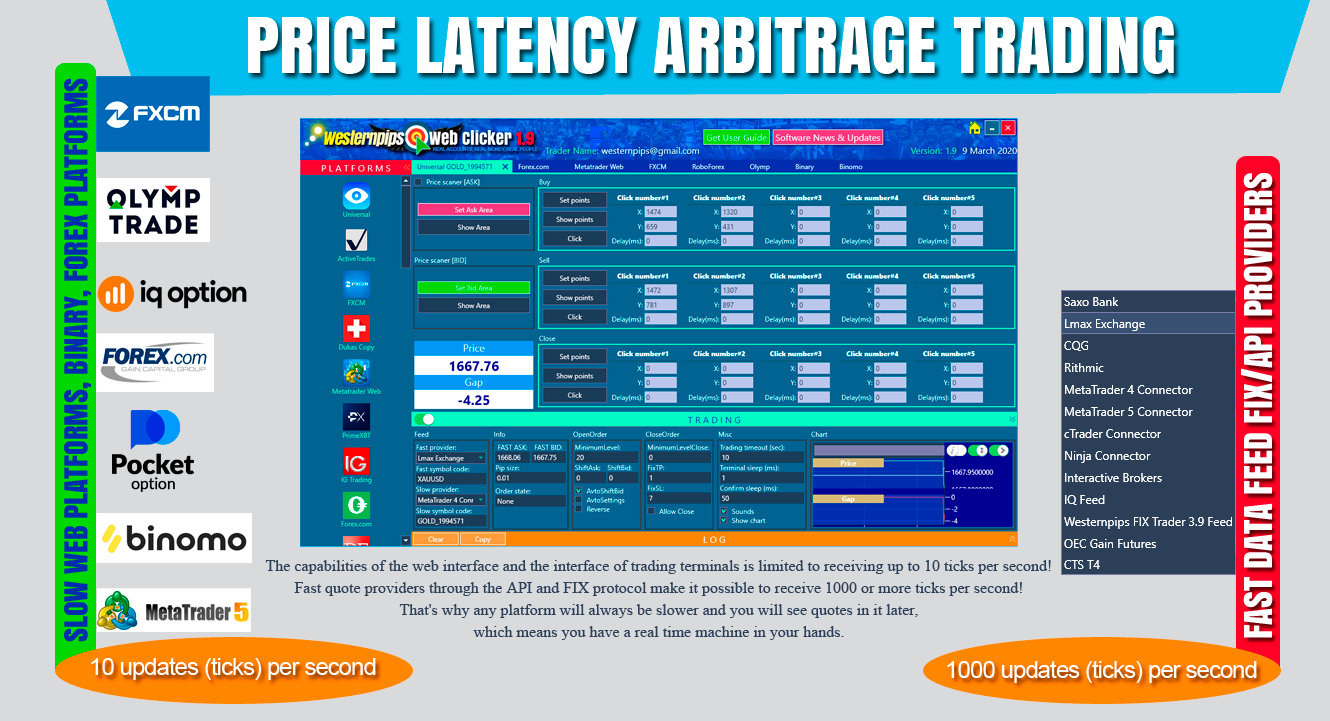

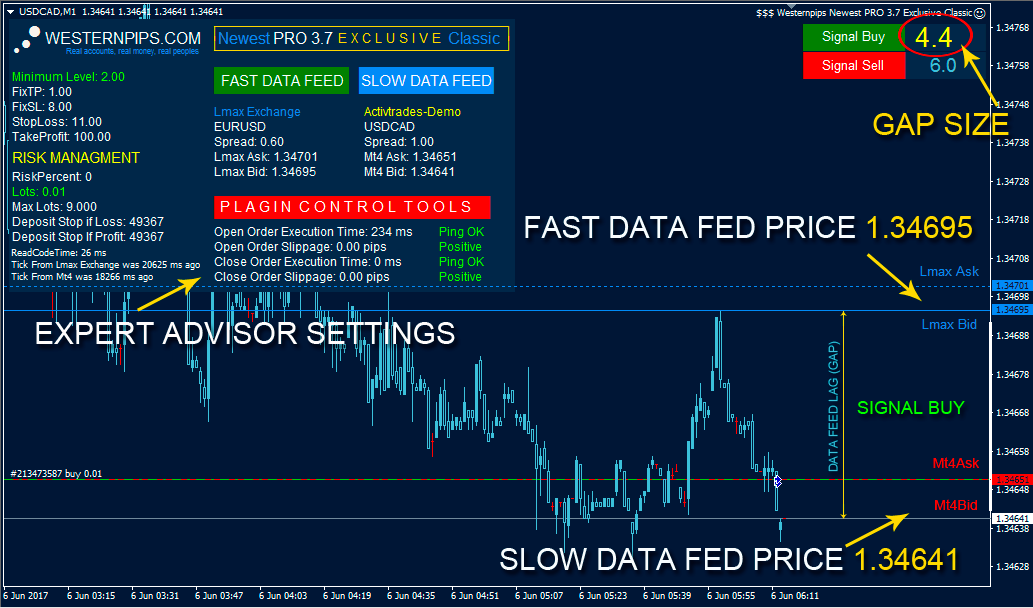

Westernpips Group發布了Trade Monitor 3.7的最新更新。 我們增加了兩個新的快速數據提供商:Gain Futures(OEC Trader API)和CTS T4 API。

閱讀更多 >>>

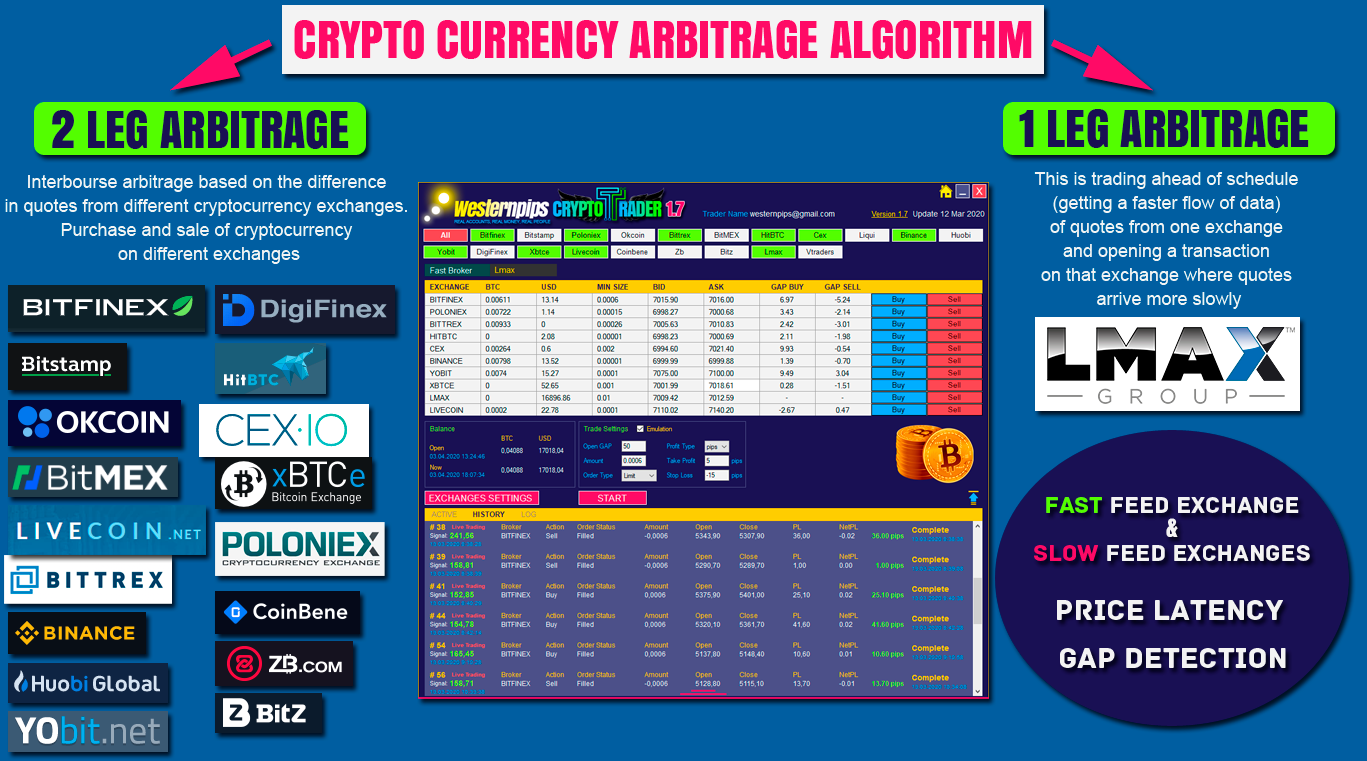

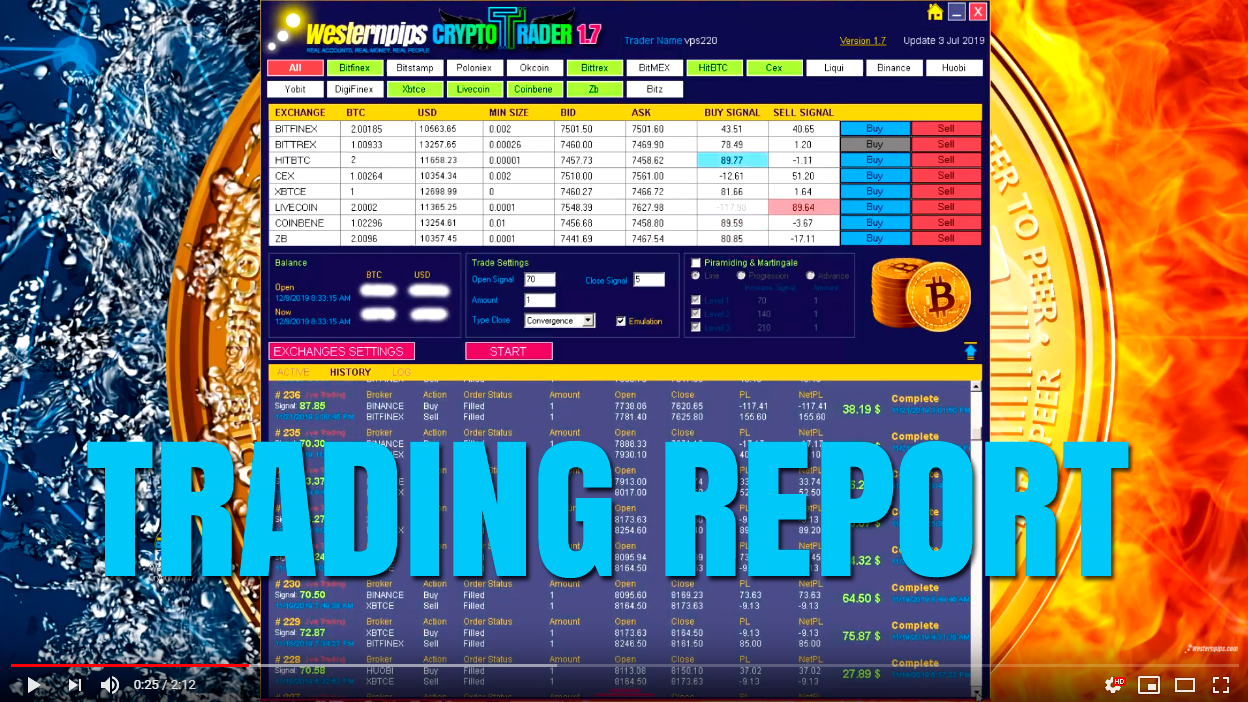

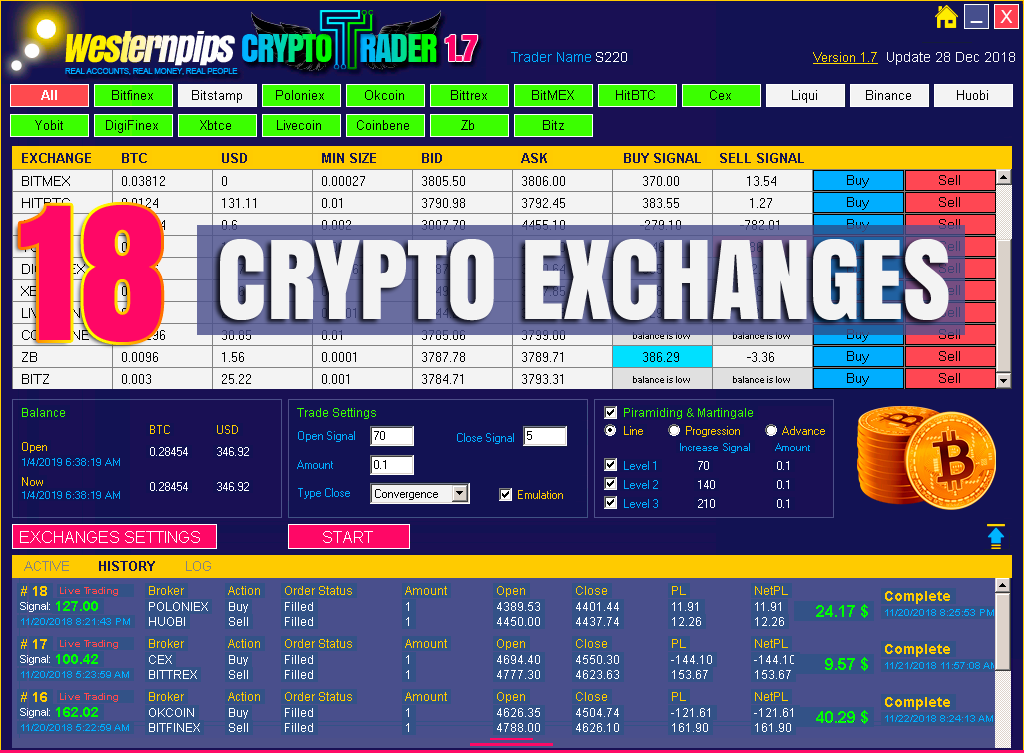

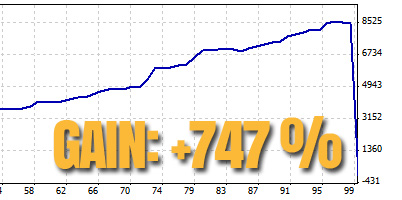

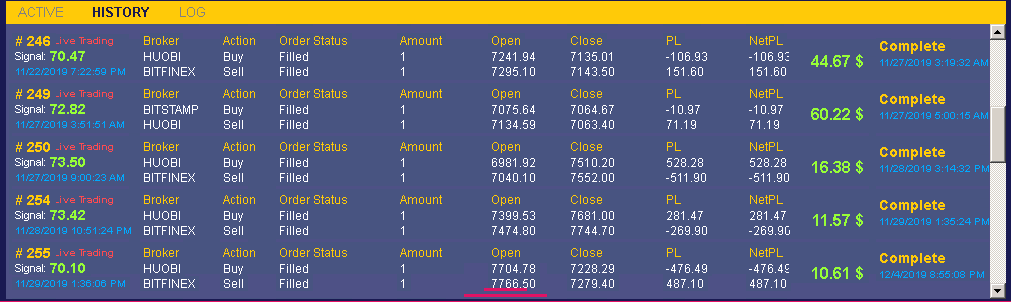

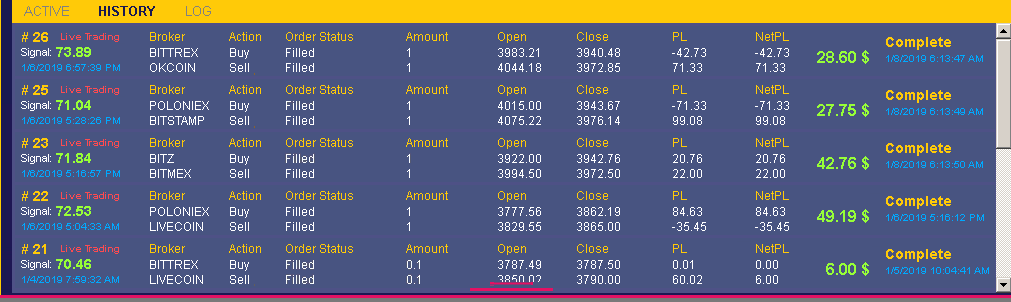

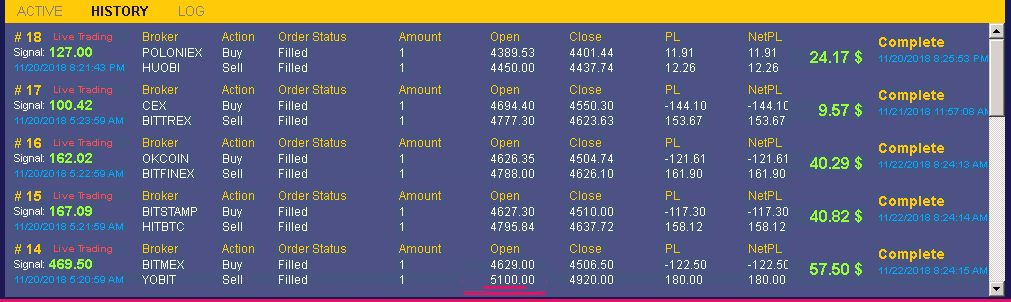

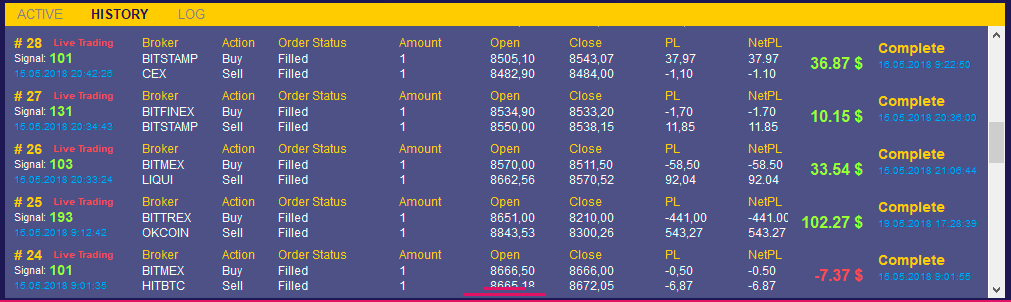

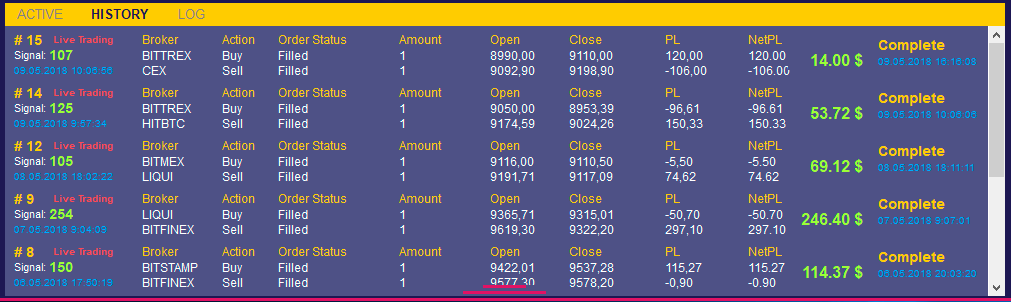

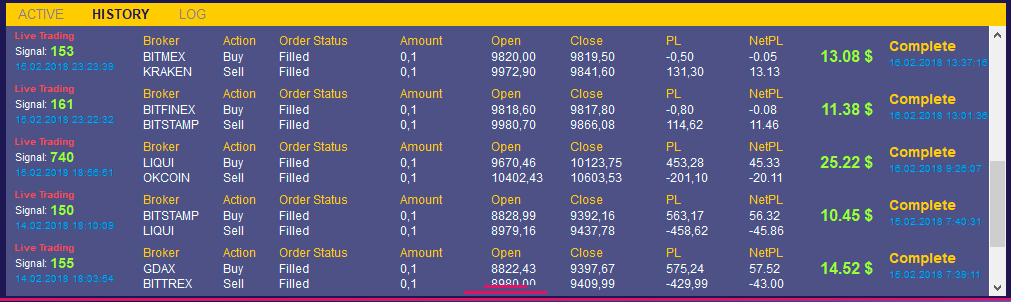

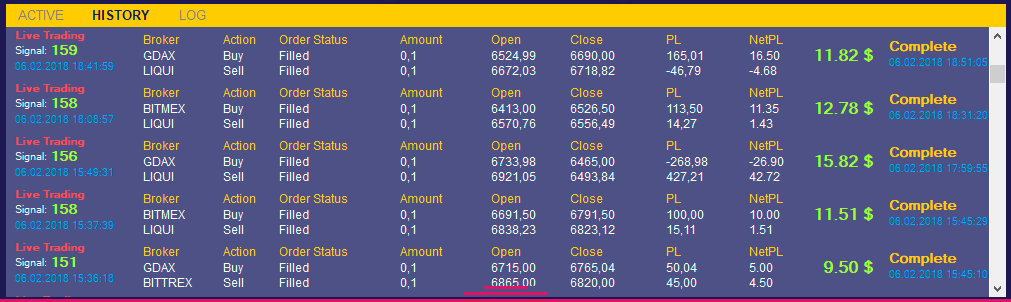

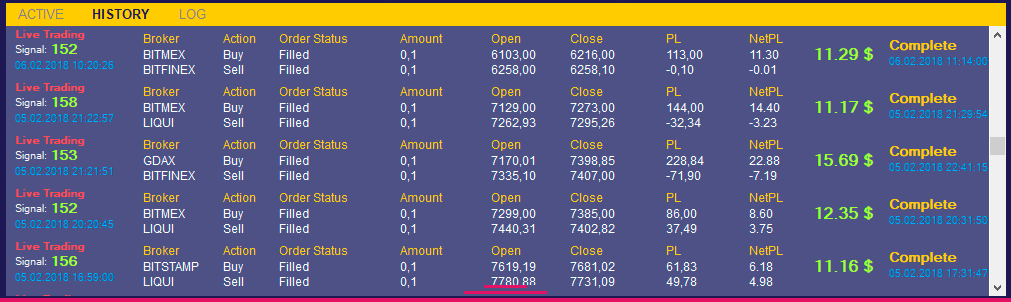

最新更新 // 交易18個加密交易所

增加了更多加密貨幣兌換:XBTCE,LIVECOIN,COINBENE,ZB.COM,BIT-Z。 現在這是一個用於加密貨幣交易的專業軟件。 各種交換和可用的加密貨幣為您提供更多使用interbash仲裁加密貨幣策略賺錢的機會。

閱讀更多 >>>

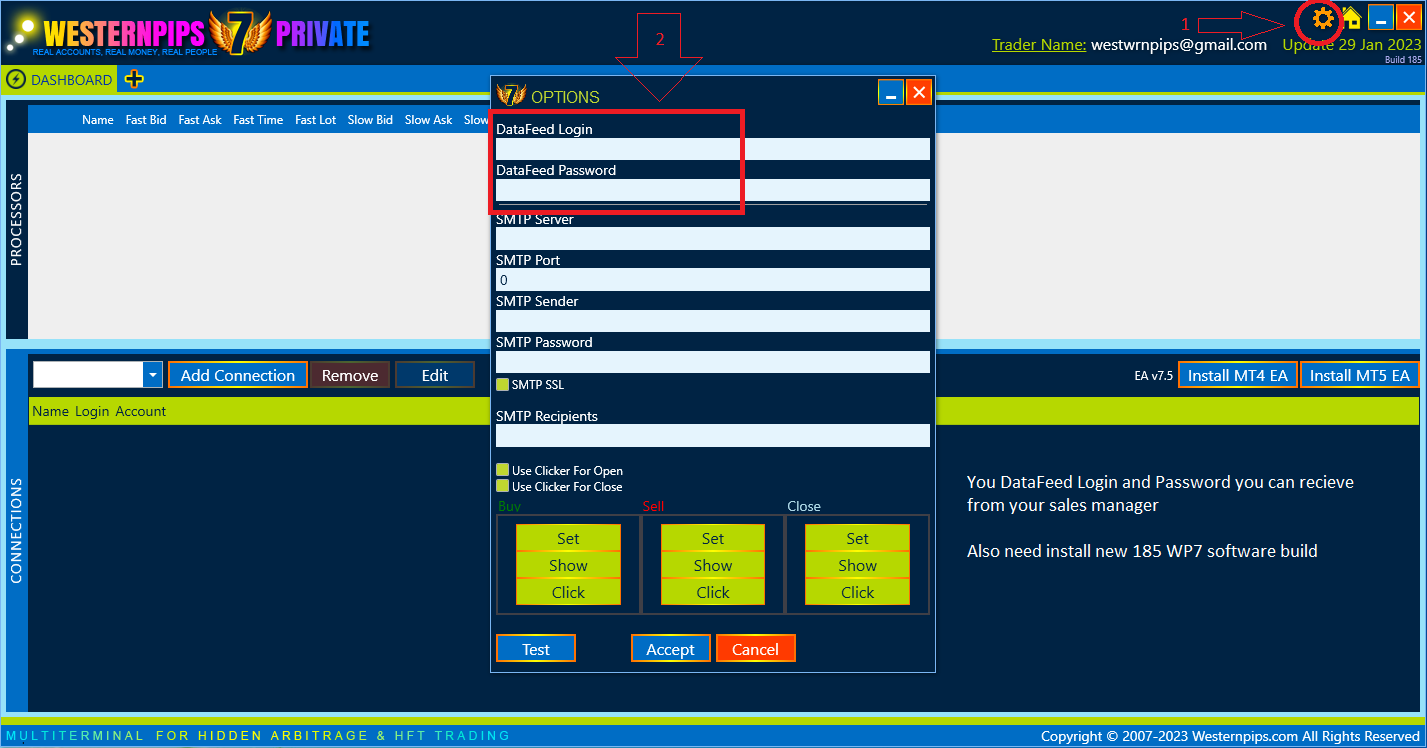

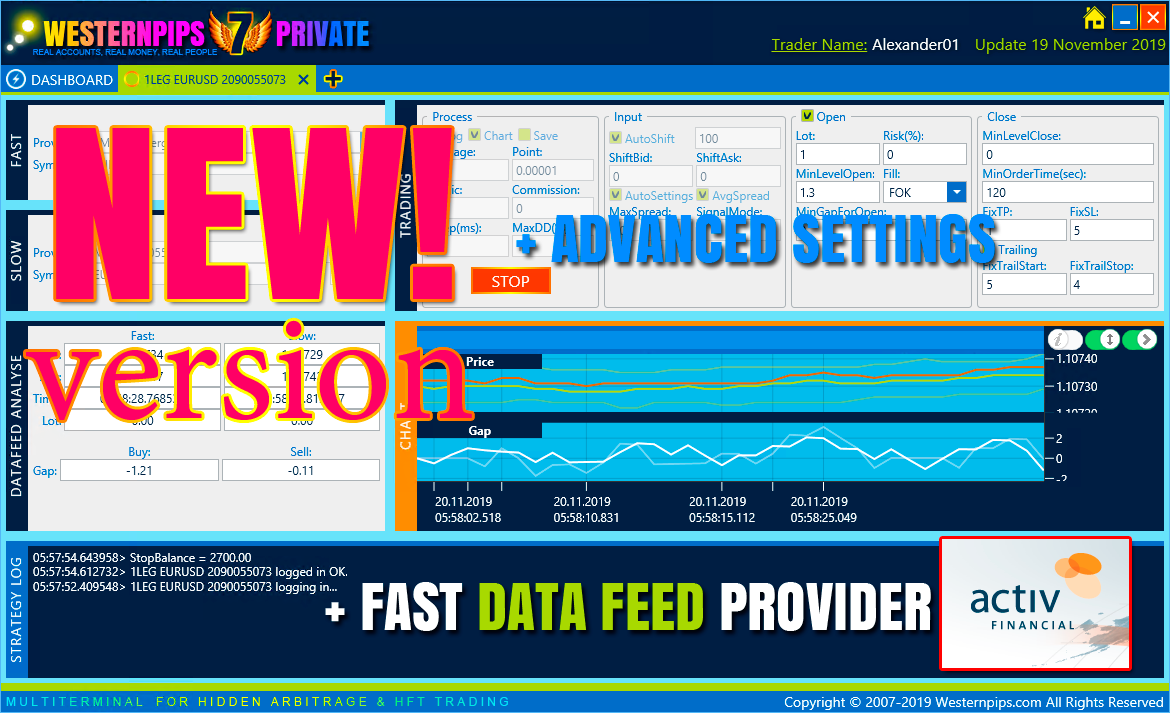

最新更新 // 多端隐藏套利和HFT!

新的多终端,无限可能!

没有Meta Trader终端的超快交易通过TCP协议使用直接访问技术。

閱讀更多 >>>

最新更新 // 新的更新! 更多的经纪人和套利机会!

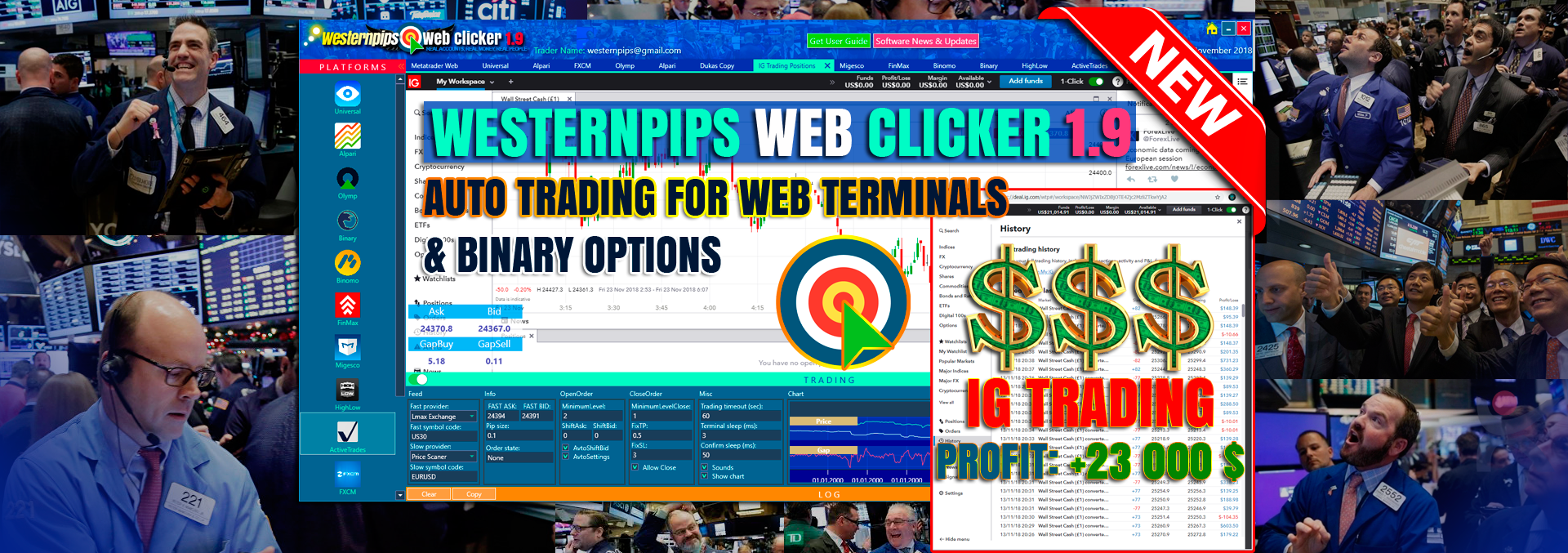

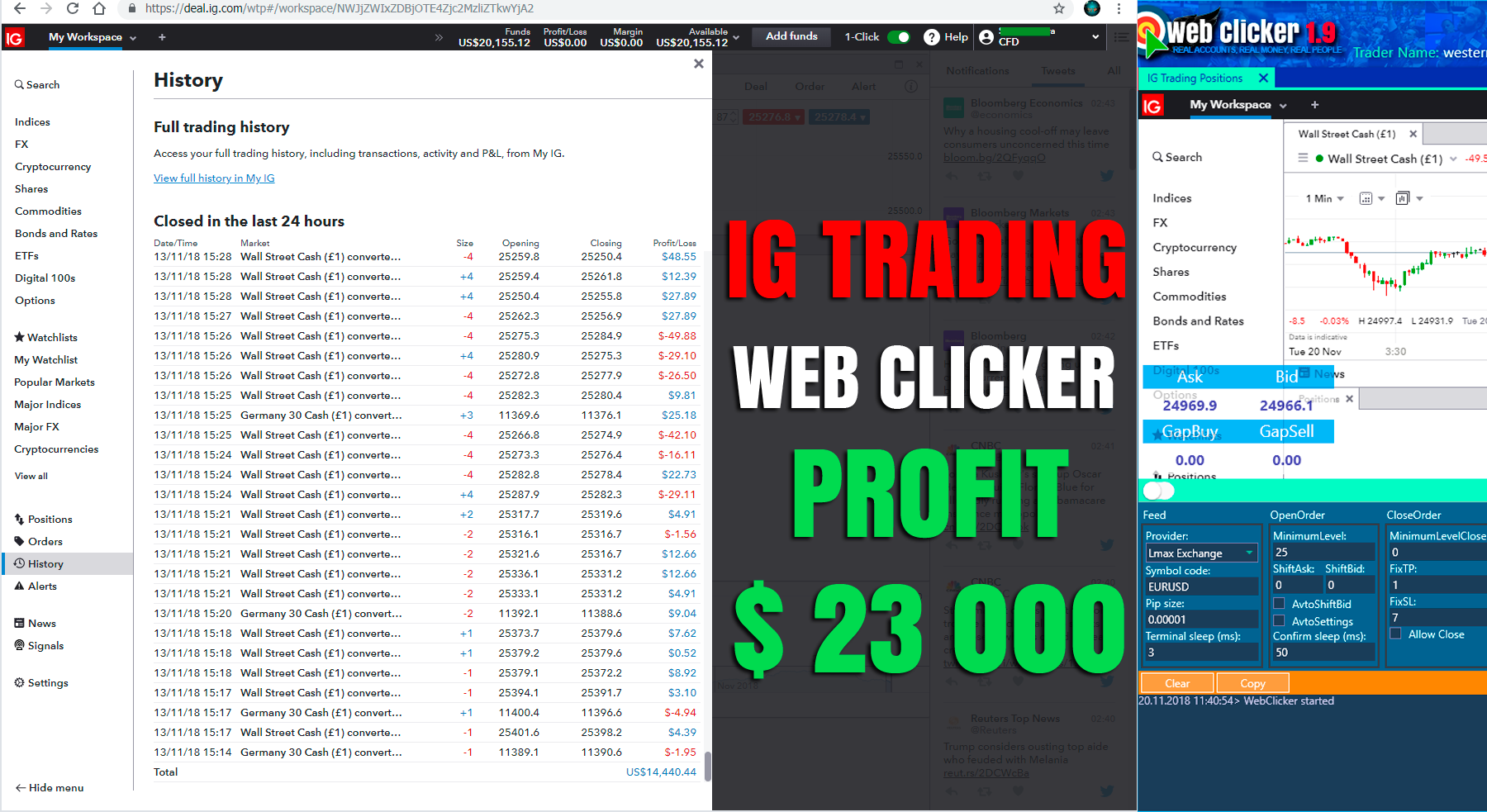

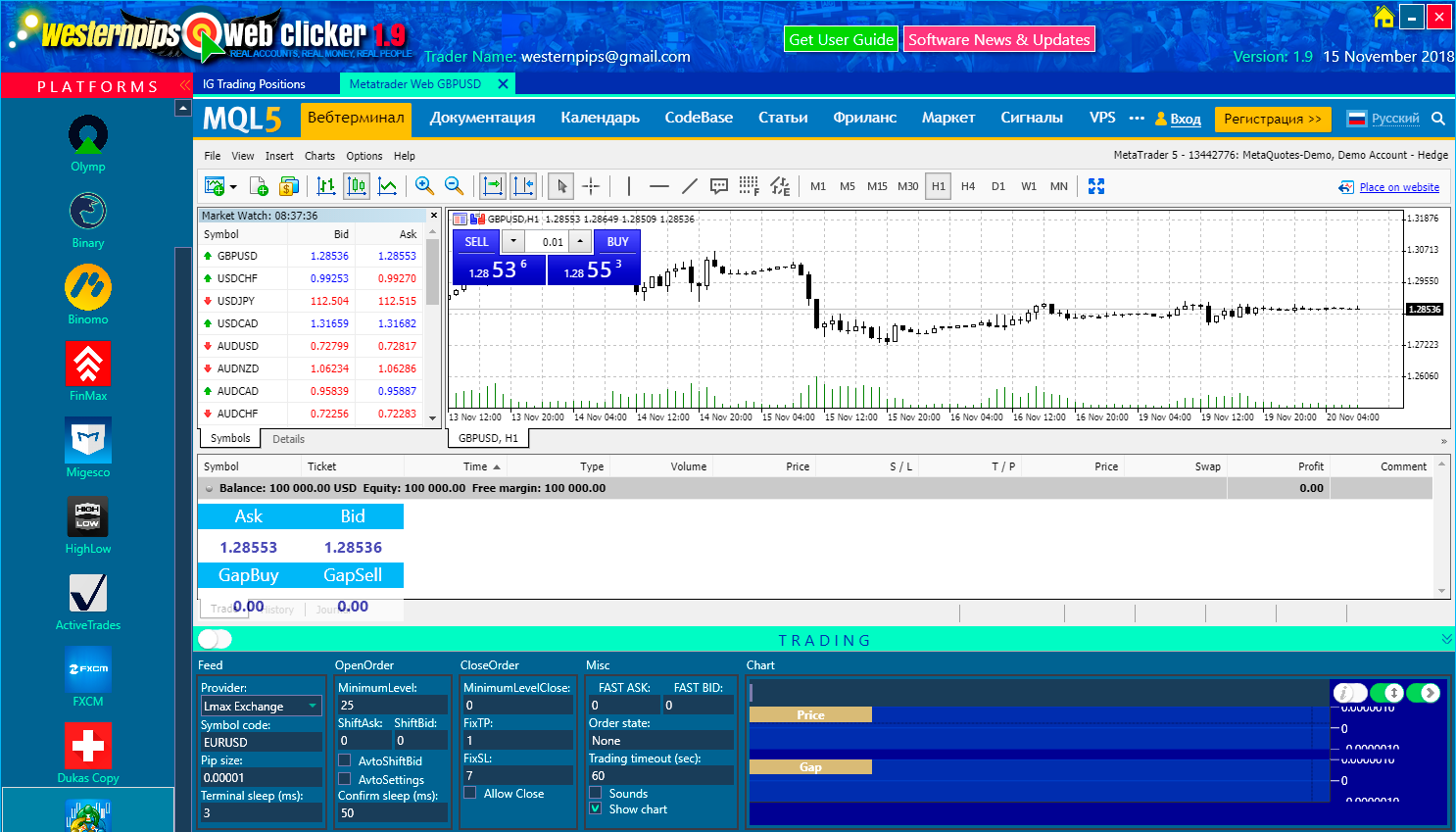

Westernpips Web Clicker 1.9的新更新已发布。

可用经纪人名单已经扩大。 更多经纪人和套利机会!

閱讀更多 >>>

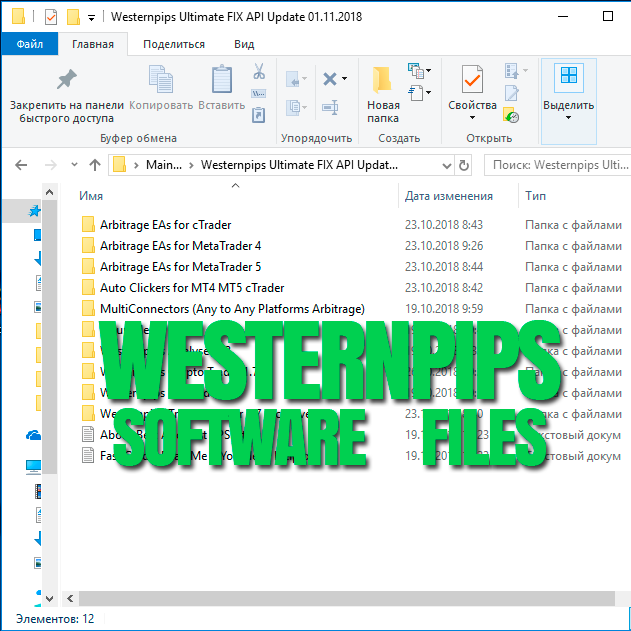

最新更新 // 新的經紀人和行李固定

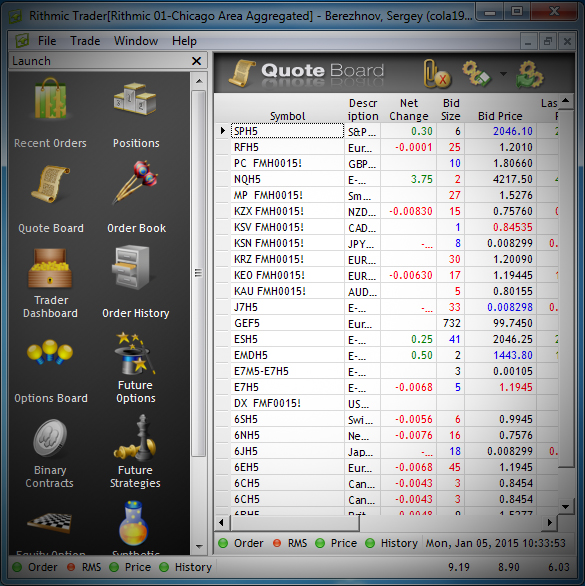

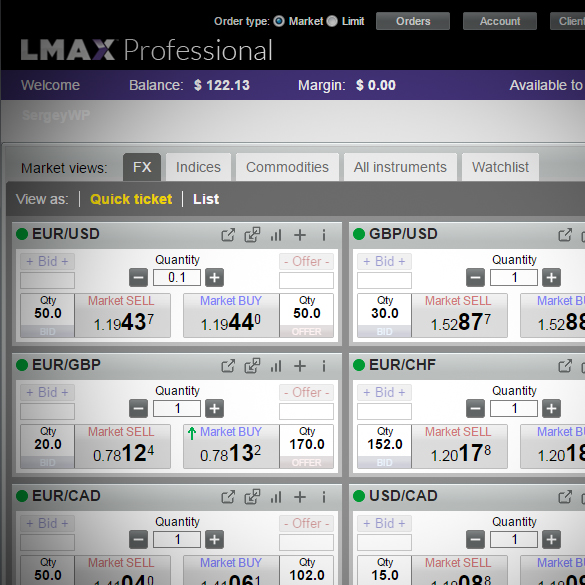

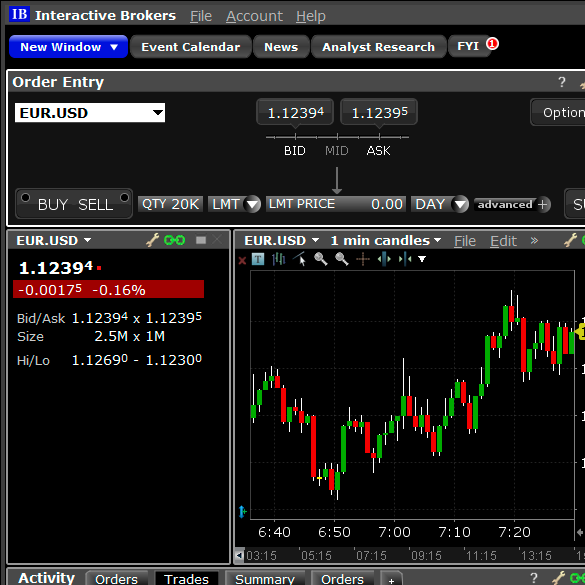

現在有更多的經紀人可以進行FIX交易: Integral, Exante, Variance, Divisa Capital, Darwinex, Prime XM,

CFH Clearing, Finotec, Trio Markets, FXCM FIX API, cTrader FIX, Visual Trading, PFD-NZ, FX Pig, LMAX, Rithmic, Interactive brokers, ForexWare.

閱讀更多 >>>

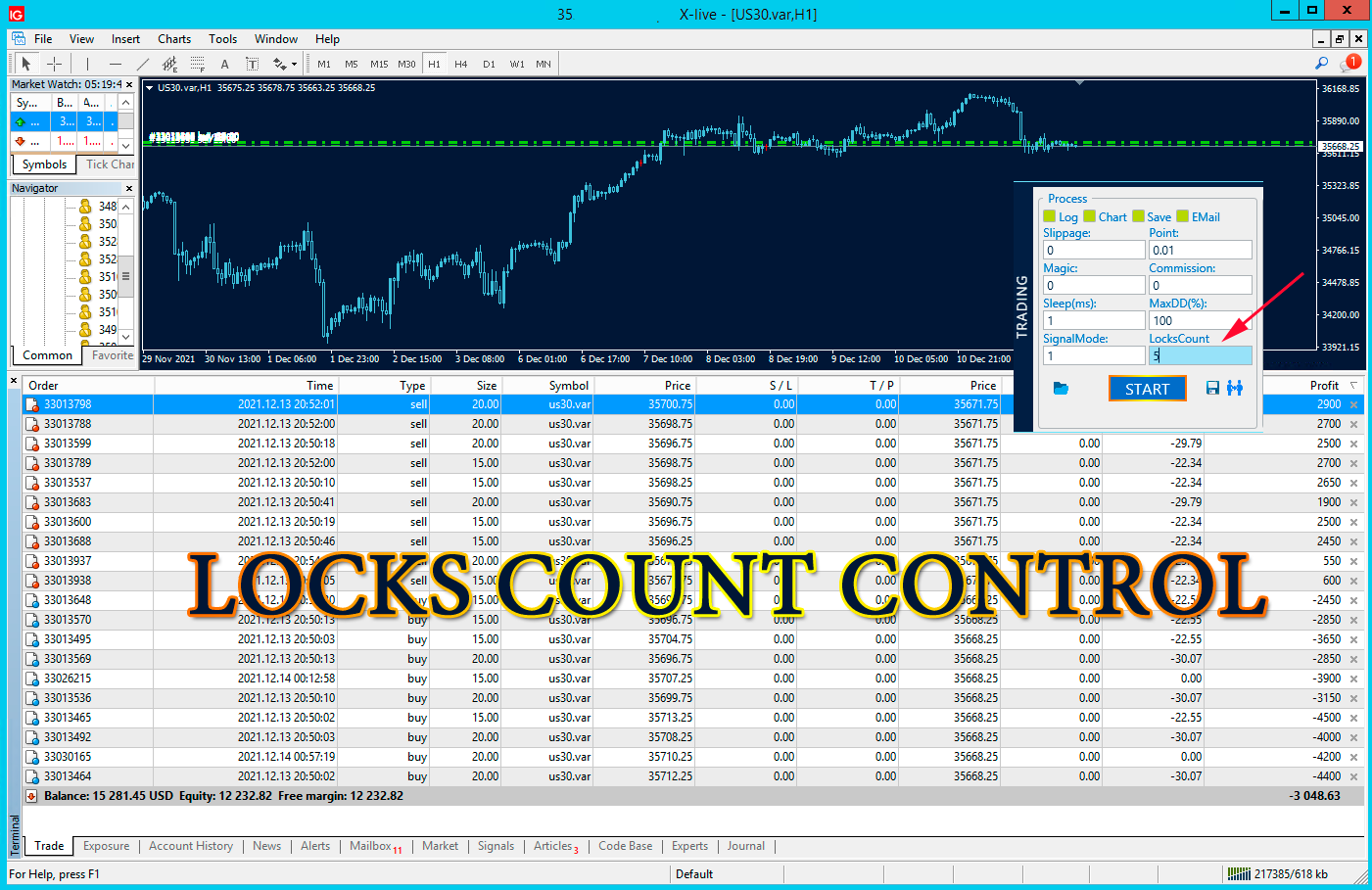

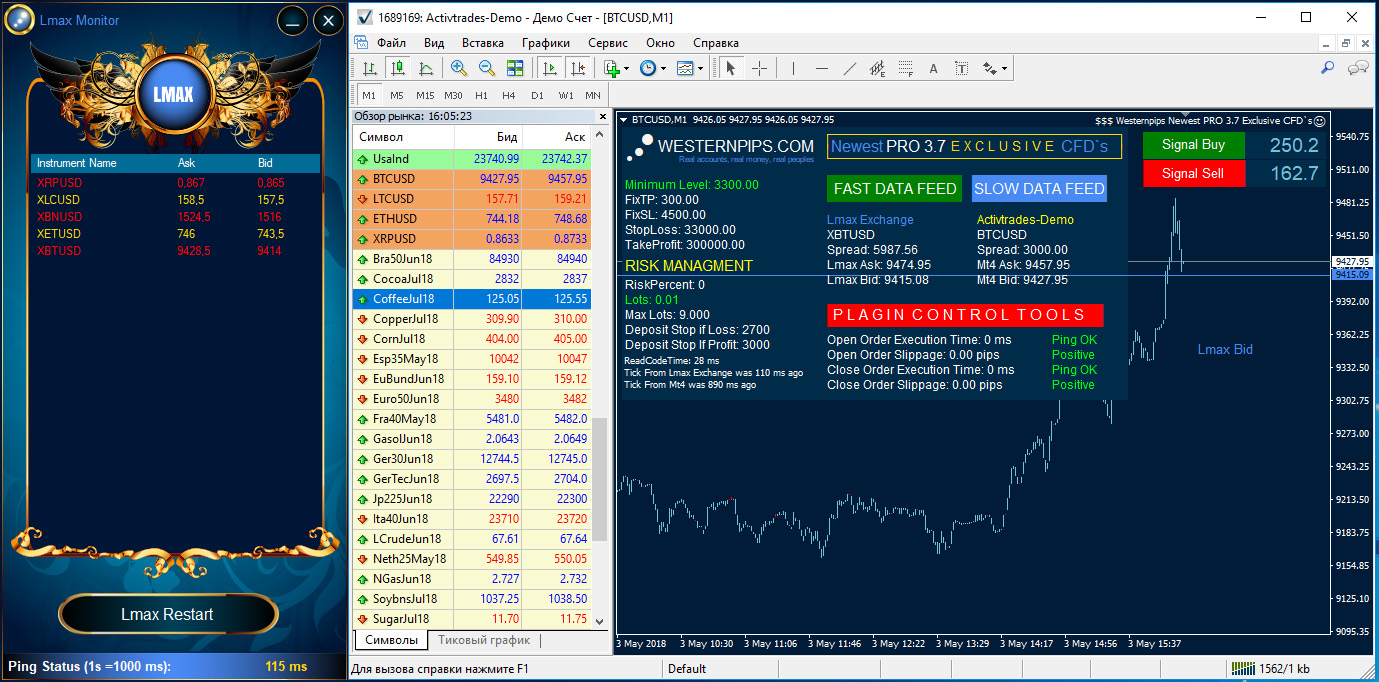

現場新聞 // 開發新版本

在開發中,該程序的新版本可能在LMAX和MT4 / MT5 / cTrader經紀人之間進行2腿LOCK套利。 在LMAX上設置鎖定順序。 此外,將更新關閉相反信號並保持位置的命令的功能。

您想在我們的軟件中看到哪些新功能? 電郵我們:

westernpips@gmail.com

新的想法

新的想法

联系 Westernpips

联系 Westernpips

编码

编码